Pretend for a minute you are a bank. Your purpose is to hold deposits and provide loans. Depositors want you to hold their money because you provide convenience, safety and perhaps a competitive rate of interest. In turn, you use these funds to loan to businesses and individuals to collect a higher rate of interest than your deposits as consideration for the risk of these loans.

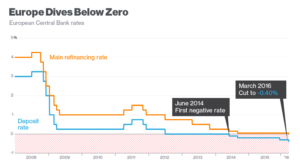

On a much larger scale, this is what central banks do across the globe. One difference they have though, is the ability to set certain interest rates. Along with other tools, the push to lower rates since 2008 has been on a downward path. In 2014, the European Central Bank went into uncharted territory by pushing its deposit rate that large banks receive below zero. In January of this year, Japan followed suit as well.

This “alternate universe” of banking is something no economist or policy maker has seen in recent times. Instead of being compensated in interest payments, some banks will now lose money if they leave certain deposits. This also lowers the rate of interest banks receive on their loans, which affects their bottom line.

The United States currently does not have negative rates, either as an economic policy or in the market place. However there is some concern that this could be implemented. What affect, if any, will it have on the markets as well as the overall economy? Will people hoard their cash, instead of depositing it at the bank? Will banks be able to operate effectively? And will businesses continue to have access to capital through borrowing to keep the economy thriving? More importantly, will this affect your investments that you are relying on for retirement or some other goal?

We believe your investment plan should follow your financial plan first and foremost. Assessing this kind of risk given your situation should look at how this could impact your financial success. Also, understanding how you might react and how you should react could be different.

Source: WSJ