Last Thursday, the United Kingdom voted in a referendum to leave the European Union. Since Friday, the worlds’ markets reacted sharply. The value of the British Pound Sterling, in US Dollars, dropped. US Treasury and other safe bonds rose in value. And stock markets across the globe fell significantly. On Friday, the Dow Jones Industrial Average fell 610 points or 3.39% and the Standard and Poor’s 500 lost 3.59%. Gold was up 4.66%. The yield for a 10 year US Treasury Bond fell to 1.56%.

The Phoenix Business Journal interviewed me about the event. What we do know right now is there’s a lot of uncertainty in Europe and nobody has a clue about the Brexit impact on Arizona.

I recently returned to the summer heat in Arizona after visiting clients out of state. Leading up to the vote, most of our conversations discussed its implications. The International Monetary Fund predicted that if the UK left, its total economic output, or Gross Domestic Product, would be hit severely in the first year. Clearly, if the UK voted to leave it would not be for economic reasons. Leading up to Friday as votes were tallied, markets rallied as polls showed more support for remaining in the EU. Thursday’s results were unexpected, as the U.K. now has to make the decision to remove itself and the 28 member European Union is looking at a future with one less. Movement among member states, including trade and immigration will be different for the U.K. The U.K. is the fifth largest economy in the world – the sudden uncertainty of this removal means a different relationship with members as well as an appeared weakness of the EU overall.

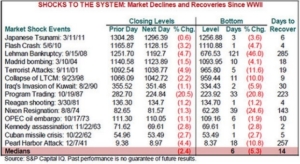

As some clients look to us to manage their investments accordingly for risk, most take the impact of these events as part of the process. These events will happen, but over time markets are resilient and shouldn’t interrupt their financial plan. Here’s a list of past events, their immediate impact, their drawdown, and how long it took to recover:

Market moving events like this usually bring on a flurry of advice of what you should do with your investments. The range of suggestions can be downright confusing. Sell everything, stay put, sell international stocks, buy gold, you name it. How do you know they have the best ideas for you specifically? And are they truly looking out for your best interest?

We believe determining where to invest only happens after first getting an understanding of your situation. For example, even though you feel you need to invest in the stock market, your situation may not warrant taking that kind of risk. And to what extent and where should you invest in the market? According to a recent Gallup Poll, only 38% of investors have a financial plan. This means at least half don’t have some context of understanding whether they should be investing in the first place!

Not everyone needs a financial planner, but everyone needs a financial plan. Understand your situation, set a goal, implement, and update it as your situation changes, not just with the market. Get help from a professional if you don’t have the time, inclination, experience, or discipline to do it yourself. If you’d like to review your own situation with me directly contact me here.